Low and middle income earner tax offset eligibility

This quick blog post outlines the newly expanded low and middle income tax offset being offered this tax time. Keep reading below to find out if you’re eligible.

Low and Middle Income Tax Offset (LMITO)

People earning up to $126,000 will get a rebate of $420 in excess of what they would have got anyway through the existing LMITO. If your taxable income is up to $126,000, you will get some or all of the expanded off-set.

The Federal Government has confirmed that 2021-22 will be the last income year when the LMITO is available and it won’t be paid in 2023, meaning that eligible taxpayers will see their tax bills rise by up to $1,500.

To be eligible for the LMITO, all you have to do is to lodge a tax return for 2021-22 and it will given automatically by the ATO. So, funds should start to flow to taxpayers from July.

How it works:

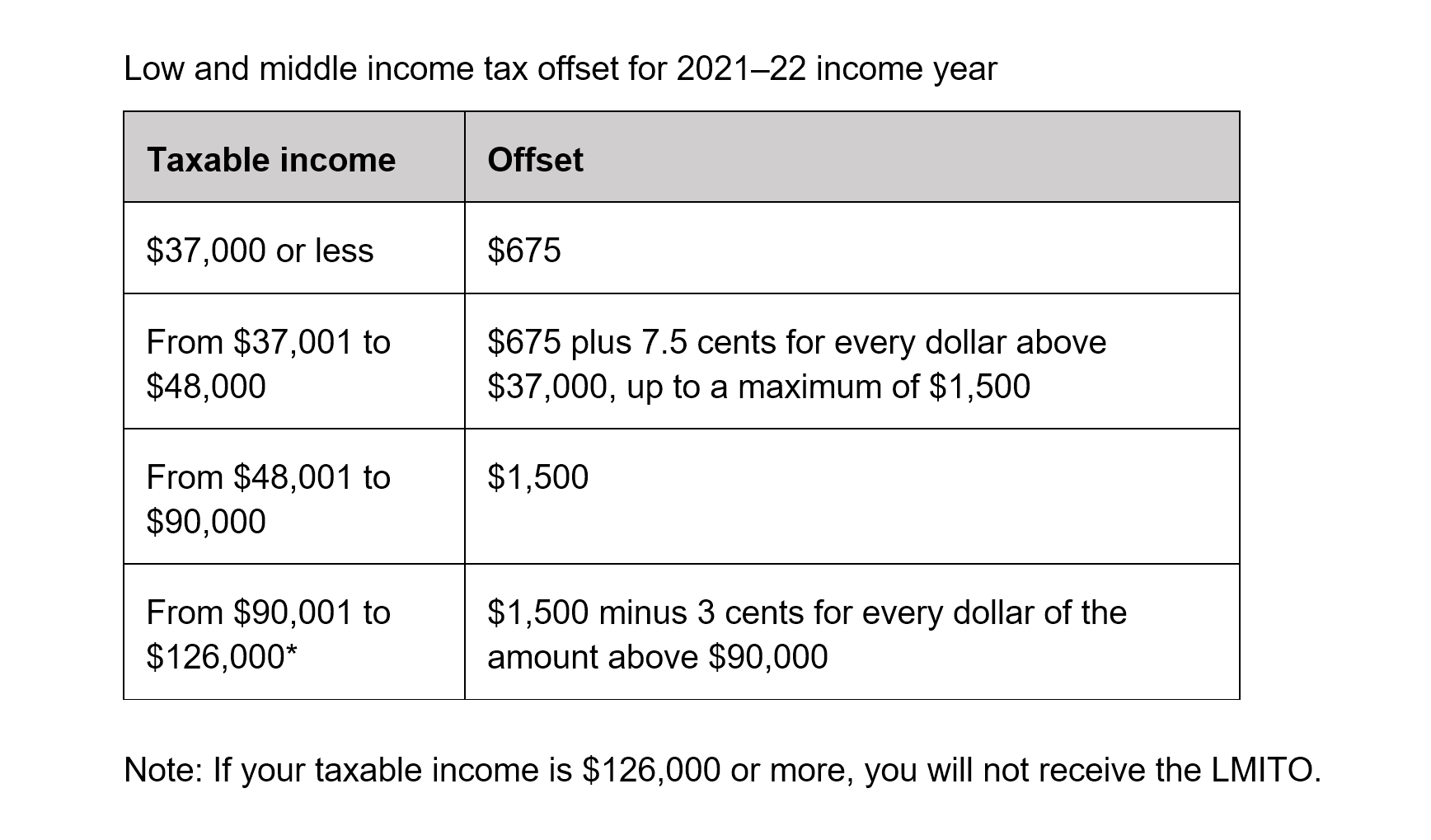

If your taxable income is less that $37,000, you will pay $675 less tax due to the LMITO.

If your taxable income is between $37,001 and $48,000, the tax offset will increase steadily to $1,500.

If your taxable income is between $48,000 and $90,000, you will pay $1,500 less tax (the maximum) because of the offset.

If your taxable income is more than $90,000, but less than $126,000, you will pay $420 less tax.

However, if your taxable income is $126,001 or more you won’t benefit at all. The LMITO offset gradually phases out, disappearing after $126,000.

Table: https://www.ato.gov.au/

If you’d like to learn more from our knowledgeable team, get in touch today.

Sources:

Tax Tip article from Mark Chapman, Director of Tax Communications at H&R Block via Money Magazine Australia

General Advice Warning

The information in this presentation contains general advice only, that is, advice which does not take into account your needs, objectives or financial situation. You need to consider the appropriateness of that general advice in light of your personal circumstances before acting on the advice. You should obtain and consider the Product Disclosure Statement for any product discussed before making a decision to acquire that product. You should obtain financial advice that addresses your specific needs and situation before making investment decisions. While every care has been taken in the preparation of this information, Infocus Securities Australia Pty Ltd (Infocus) does not guarantee the accuracy or completeness of the information. Infocus does not guarantee any particular outcome or future performance. Infocus is a registered tax (financial) adviser. Any tax advice in this presentation is incidental to the financial advice in it. Taxation information is based on our interpretation of the relevant laws as at 1 July 2020. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Any case studies included are hypothetical, for illustration purposes only and are not based on actual returns.